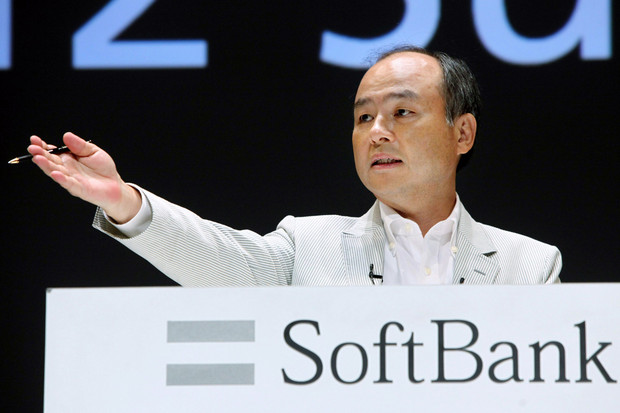

Softbank's CEO Masayoshi Son announced that the company plans to invest as much as $880 billion into tech companies across the globe.

Son, Japan's wealthiest man, confirmed that his Vision Fund, a $100 billion tech investment fund, is just the first step in a series of investments.

"The Vision Fund was just the first step, 10 trillion yen ($88 billion) is simply not enough," CEO Masayoshi Son said in an interview with The Nikkei Asian Review.

"We will briskly expand the scale. Vision Funds 2, 3 and 4 will be established every two to three years," he added.

"We are creating a mechanism to increase our funding ability from 10 trillion yen to 20 trillion yen to 100 trillion yen," Son told the outlet.

Son did not elaborate on how he plans to source the investments.

ソフトバンク、ファンドを通じて技術業界に大規模な投資

ソフトバンクは、ビジョン・ファンドの少なくとも3回の反復を通じて、テクノロジー企業に約8,800億ドルを投資する予定であると、孫正義CEOが日経に語りました。同社は、今年第1回ビジョン・ファンドのために調達した1,000億ドルの世界最大のプライベート・エクイティ・ファンドを既に支配。しかし、莫大な資本は、単に「第一歩」であり、今後2〜3年での第2のビジョン基金設立に向けてすでに取り組みは始まっている、と孫正義氏。日経で同氏は「規模を積極的に拡大する」予定であることを明らかにしました。ビジョン・ファンド2・3・4は、2〜3年ごとに設置される予定です。孫正義氏によると、ソフトバンクは今後10年間、人工知能やロボット技術などの分野で少なくとも1000社のハイテク企業に投資する計画とのこと。このような投資の方針からは、ソフトバンクによる最新技術への飽くなき信頼と愛情が伺えます。ソフトバンクは、Apple、Qualcomm、サウジアラビア政府などに資金提供を呼びかけることでビジョン・ファンド構築にこぎつけました。孫正義氏は、ファンドの各反復を1兆ドル近くに指数関数的に成長させる計画だと述べています。ソフトバンクは、今年、Brain Corp、Mailbox、Boston Dynamics、Improbable、Nvidia、Slackなど幅広い企業に投資を行ってきました。 Uberの取締役会の一員であるアリアナ・アフィントンは最近、ソフトバンクがUber の株式の14%から20%を取得する方向へ着々と歩みを進めていると述べています。

软银计划通过更多的愿景基金向科技公司投资约8800亿美元

软银CEO孙正义最近告诉日经新闻,软银计划通过其愿景基金,向科技公司投资约8800亿美元。

根据孙正义的说法,大量的资本只是“第一步”,孙正义表示他正在努力在未来的两三年里建立起第二个愿景基金。

“愿景基金2,3,4将每两到三年建立一次。” 孙正义表示,软银计划在未来十年内投资至少1000家科技公司。

软银说服了苹果,高通和沙特阿拉伯政府支持了其第一个愿景基金。孙正义表示,他计划将基金增长到接近一万亿美元。

孙正义说:“我们正在创造一个机制,将资金从10万亿日元提高到20万亿日元,再提高到100万亿日元。”

软银今年已经投资了多家公司,包括Brain Corp,Mailbox,Boston Dynamics,Improbable,Nvidia和Slack。

Sterling House Trust is a private trust with a difference. It offers its members an exclusive and reliable platform to access unique opportunities and lifestyle services reserved for the select few. With its team of professional managers Sterling House Trust constantly scans the markets and collaborate with reliable global partners to create a portfolio of carefully curated programmes for its members. Members can access these programmes according to their individual needs, interest and financial capacity. Sterling House Trust is headquartered in Auckland, New Zealand, and has operations based in London, UK.

The Sterling House Trust platform was established with the objective of providing its members, secure access to opportunities across a range of global locations, sectors and services.

Our unique Platform was established within the framework of a trust so that the trust would have oversight and governance over the range of services and its quality. Member protection is a core principle and drive in all that we do. Our trustees ensures that the interests and quality of service provided by the Platform are always maintained at the highest standards.

The trust and its trustees provide robust oversight and is constantly on the move to identify and shortlist select opportunities in the international markets. Likewise, we apply the same stringent standards in identifying and selecting providers and professional partners to join our Platform.

The Sterling House Trust Platform utilises our international footfall and relationships to provide our members with access to a range of international opportunities via our global network which covers a broad range of sectors including:

Asset protection, international property ownership and management, alternative and direct ownership, estate planning, banking services, foreign exchange, card services, alternative investment and lifestyle services.

New Zealand Head Office

31/335 Lincoln Road,

Addington

Christchurch

New Zealand

London Office

14-16 Dowgate Hill,

London,

England EC4R 2SU